Open Interest data simply shows us that how many contracts are open at specific period of time. For every open futures and options contract, there is a buyer and seller. These contracts remain open as long as anyone one of them choose to close it (or they are settled on expiry). Therefore, if you are successfully able to read Open Interest data then you will be able to predict market direction and can take timely entry and exit.

Most of the newbie traders trade without considering OI data. And few of them who use it, use it wrongly.

Today I will be showing a simple Open Interest trick that you can use it in your trading system to increase your chances of winning.

It does not take too much of your time but it is super effective. I have been using OI data in this way for the last 1 year and it is working like a charm. So let's understand how to read open interest data like a professional trader.

Open Interest (OI) Trick in Options Trading to Make Money

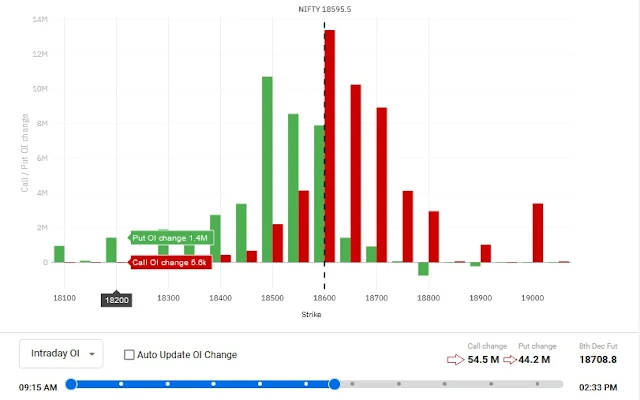

See highlighted open interest data and let me know as the data where market is supposed to go?

Obviously, CALL OI is higher than PUT OI which means from a retail trader point of view market should go up. A retail trader reads open interest data this way.

And relying upon the OI data, a retail trader would take bullish trades and he would preferably buy CALL options (because if market would go up, CALL options prices would alos follow it).

This is the main mistake if you could understand.

Yes, it is crystal clear from the above screenshot that CALL open interest is almost double the PUTs.

But, we ignore the fact that someone is selling those CALL options strikes. If you're buying a CALL option, it means someone else is selling.

Who are those sellers?

Are they fool?

As a CALL option buyer, your loss is limited. But on the contrary, person who sold that CALL option (or precisely saying CALL Writer) would incur unlimited loss in case market went up.

These options writers are called smart money holders who deploy their capital with proper money management and risk management. They know they are exposed to unlimited loss but they would never let it happen. They always cut their loses timely and hold on tightly when conditions are in their favor.

But our poor retail trader always does the inverse. A typical retail trade never exits until the options melt completely and he loses his entire paid premium. And when market goes in his favor, he impatiently exits and books small profits.

So, what you need to understand and do when reading OI data?

Super profitable trick to use open interest with candlestick chart

Whenever you find there is significant difference between PUT and CALL open interest data. Let's take above screenshot as an example where CALL and PUT OI are 56.3M and 20.2M respectively.

Here CALL open interest is more than twice the PUT. As I mentioned earlier, a typical retail trader would see it as a bullish signal.

But not you.

You will see it as a bearish signal.

Why?

Because as I told you, for an active contract, there is a option buyer and seller. As an contract buyer you need to pay equal to total premium but option seller has to have 10x margin to sell the same contract because his loss is unlimited.

So smart money is selling CALL options and they will do their best to keep the market down till the expiry so they can take advantage of Theta decay.

As per the OI data where CALL OI is higher, it shows that options sellers don't want to let the market go up. They have good amount of money to beat the options buyers.

You can beat them only by replicating their point of view. For example, OI data is clearly showing you options seller or writers would not let the stock market go bullish.

So you should agree with them. Okay, you would not let the market go up, you want it to take lower levels. Fine. I agree with you. Instead of buying CALL option, I will buy PUT.

What I want to say you is agree with options sellers view. And take trades as per their willingness. If they are selling CALL options then you don't go against them. You should buy PUT options in this case.

To sum up, if you find that CALL OI is more than PUT then understand market would go down and you should buy PUT options. On the other hand, if you would find that PUT OI is more than CALL OI then understand market would go up and you should buy CALL options.

Wait!

It is not over now. You have add something more important to this options trading trick, which is candlestick chart.

Once you find that OI is in favor of one direction then it does not mean you should login and buy opposite side Options. If it was that simple then everybody would be a profitable trader.

So what you need to do is first wait till the OI data goes in one direction. Then you will decide that you will buy opposite side options. For example if CALL OI is high then buy would buy PUT or vice versa.

Here, this options strategy demands so much patience.

Are you willing to give it?

Next, you will draw support and resistance on candlestick chart (watch my candlestick course to understand) and then you will patiently wait for a breakout in the favorable direction. For example, if CALL open interest is high then you would buy a PUT option so here you would wait till market breaches support. Similarly, if PUT OI is higher then you would buy a CALL option when resistance is breached.

Just follow this options trading trick for at least 21 trades and you will fund that you eventually become a profitable trader.

What this trading strategy demands is:

Patience!

You will be required to wait for hours before our entry criteria fulfills but this is the way to earn from market.

No matter how good you stock market knowledge is. If you don't have patience then you are gone. No matter how many times you reload your account with money, you are gone.

As discussed in my trading mistakes post, here patience is the key.

I would be too happy to come up with more trading strategies if you can let me know whether this trading strategy worked for you or not.

Comment if you want more strategies like this.

Comments

Post a Comment

Have a question? Just ask in comment box!