In today's post, I'll be taking you throug Yono SBI registration or you may say SBI mobile banking activation process. If you would like to avail bank's digital banking services through your phone then follow the instructions given below.

State Bank of India has replaced SBI Anywhere mobile banking app with its latest and very user friendly app, SBI Yono. Actually, State Bank of India's latest mobile banking application has two versions: SBI Yono and SBI Yono Lite. Customers can install either app to avail digital banking services of the bank.

New and existing customers have to complete SBI Yono registration to use mobile banking service of the bank. It's a kind of internet banking and mobile banking merger because after installing the app, customers can use same user ID and password to login to app or internet banking service.

Though, it's an appreciable effort from State Bank Group but some customers are facing difficulties in registration process through 'New User Registration' link. So, I've come up with a very effective solution which would make your SBI mobile banking registration experience seamless.

Personally, I'm very satisfied with SBI Yono Lite app. Its interface and user-friendliness really deserve a thumbs up. All the bank needs do to further enhance customers experience is to work on the issues users are facing while going through SBI Online Yono activation (when they choose 'New User Registration' option, activation using net banking username and password is seamless and very quick, it hardly takes 2 minutes).

Before I show you how to create Yono SBI digital account, let's first know what activities you can perform using bank's latest mbanking application.

Benefits of creating Yono SBI digital account

- Check your State Bank of India account balance on the go from anywhere, anytime.

- See real-time debits and credits and monitor your account with an eagle eye.

- Send money from your bank account using SBI Yono Lite app via Quick Fund Transfer, NEFT, IMPS, or RTGS.

- Order a bank cheque book online without visiting your bank branch and cancel payment of cheque at anytime.

- View or download your account statement in PDF format for free.

- Open e-deposit account

- Avail online recharge facility to do mobile top up, recharge, and pay your credit card bills.

- Block debit card; if it gets lost/stolen.

- Request a new debit card.

- Make ATM withdrawals without ATM card (for that purpose install SBI Yono instead of SBI Yono Lite)

- If you would like to unlock more features like online shopping then install SBI Yono full version which is a complete banking solution.

- Bank offers Yono SBI digital account facility for free. By creating an account on the app, you can almost do all banking related tasks.

Step-by-step Yono SBI registration process

SBI mobile banking registration has become very easy since the bank has launched its new smartphone app. For Yono SBI registration, users get two options:

- by using SBI net banking login ID and password- If you're using SBI internet banking service then you can opt this option to login to SBI Yono Lite by using your internet banking login credentials.

- by tapping on 'New User Registration' link and providing account and debit card details- If you've never used either SBI internet banking or mobile banking before then you can select this option to get registered on the app.

From above two options, I think SBI Online Yono login using internet banking credentials is more easier than opting 'New User Registration'.

Next, I am going to explain both ways one-by-one, you can opt any preferred way to complete SBI mobile banking activation.

Must read: How to invest in share market beginners' guide

SBI Yono registration using internet banking credentials

Watch above video to register for Yono SBI app or if you prefer written instructions then continue reading.

If you would like to register for State Bank of India mobile banking service using internet banking credentials, then first you will need to get registered for net banking service.

I recommend you to opt this way because I found it easier and it's error free. You will not face any issue.

For that purpose, first read this post, "SBI net banking online registration for new user," to activate internet banking service of the bank.

Once you have your net banking login ID and password, come back to this post and follow the instructions.

If you think it's very time consuming then for your information, SBI net banking activation will take 10 minutes and Yono registration will take your 2 minutes. So entire Yono SBI registration process would hardly take 15 minutes.

Have you activated SBI net banking? Yes, then continue reading to know SBI Yono login process.

First, go to your phone's app store e.g. Google Play Store and install SBI mobile banking app - SBI Yono.

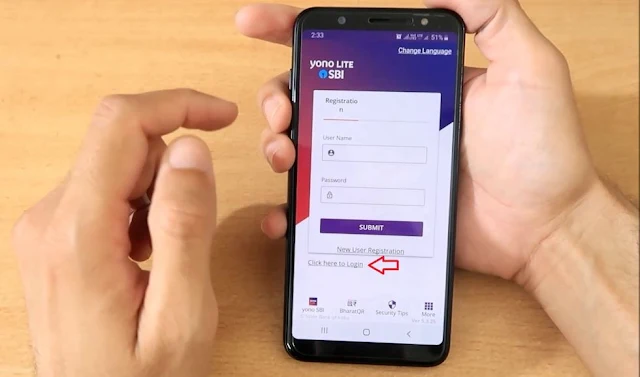

Open the app and from the homepage, tap on 'Click here to login'.

Enter your SBI internet banking user ID and password in respective fields and hit 'Submit' button.

Accept the terms and conditions by ticking the checkbox next to, "I accept the terms and conditions."

Next, you will receive a high security password on your mobile number, available in the bank records. Enter the password you received in 'Enter Authentication Code' field and touch 'Submit' button.

Congratulations! You have successfully completed SBI Yono registration process. Tap on 'OK' to proceed.

Now for SBI Yono login, enter your internet banking username and password and then touch 'Login' button.

Once you get successfully logged in, you will be asked to enable 'Easy PIN'. I suggest you enable it to login to your SBI Yono app using easy PIN; for future logins. For that purpose, tap on 'Enable Easy PIN'.

To set up 6-digit login PIN for your Yono app, toggle button next to 'Enable Easy PIN Login' then enter and verify your 6-digit PIN. Subsequently, tick checkbox next to 'I accept terms and conditions' and then tap on 'Confirm' button.

Again, you will receive a one time password. Enter it into the given field and hit 'Submit'.

Now you're good to go, start using your Yono SBI digital account.

Read: Is online banking safe?

SBI mobile banking registration as a new user

One can also try Yono SBI login online registration using 'New User Registration' option. For that purpose, make sure you've following things handy:

- Bank account passbook

- State Bank debit card

- Registered mobile number

Follow the steps given below for SBI Yono registration:

Install and open SBI Yono app and tap on 'New User Registration'.

Tap on 'Proceed'.

Enter the asked details such as account number, CIF number, branch code, registered mobile number, facility required and in last field enter captcha text showing below. Subsequently, touch 'Submit' button.

Important: In 'Facility Required', must select 'Full Transactions Rights'.

On the next page, enter your debit card details and tap on 'Submit'.

Enter high security password, you've received.

That's SBI Yono registration has been partially completed. Now wait for temporary username and password; which will be sent to your registered mobile number.

Facing issues? If you're having trouble in creating Yono SBI digital account using this way then I advise you follow way 1, that's easy and error free.

Once you receive temporary details. Open your Yono app and choose 'Click here to login' and enter the credentials for SBI Yono login.

Set permanent username and password for your account. After completion, you will be using the same username and password to avail internet and mobile banking services of State Bank of India.

You will also be asked to set easy PIN for your SBI Yono app. Set it to login to the app in future by using your 6-digits PIN.

Frequently Asked Questions

How can I register for SBI mobile banking?

State Bank of India customers can register for SBI mobile banking by using either their internet banking username and password or by registering as a new user who doesn't have internet banking account. To register using your SBI net banking credentials all you need to do is just install SBI Yono app, enter your username and password that you use to login to your SBI Online account and enter high security password which you will receive on your registered mobile number.

If you would like to register as a new user then tap on 'New User Registration' link and provide the asked details.

What is the use of Yono SBI app?

SBI Yono is an official mobile banking application of State Bank of India. The app enables users perform banking activities including fund transfer, view account statement, order a cheque book, stop cheque payment, request debit care, pay credit card bill, do online recharge, monitor account activities and more.

SBI Yono app is available free-of-charge. The bank encourages its customers to use its digital banking solutions do banking remotely.

Which is better Yono or SBI anywhere?

State Bank has officially replaced SBI Anywhere mobile banking app with SBI Yono Lite for customers having smartphones. In simple words, SBI Anywhere Personal is no more officially available for download or install from the bank side. To safeguard your financial and personal information, do not install SBI Anywhere app from unreliable sources instead use new official SBI Yono Lite app.

How much money we can transfer from Yono SBI?

Yono SBI app transaction limits depend upon transaction type and payment mode. Following are some limits of SBI Yono app:

- Users can transfer up to ₹10,00,000 using NEFT and RTGS (for interbank transfers)

- If sending money using 'Quick Transfer Facility' then per transaction limit is ₹10,000 and daily is ₹25,000

- Similarly UPI transfer daily limit is ₹1,00,000

- Transfer within self account limit is 2 crores per day.

For more details, visit this page.

Is there any charges for SBI Yono?

The SBI Yono mobile banking app is available free of charge in two languages: Hindi and English. Users can perform non-financial banking activities such as check account balance, view account statement, mpassbook, block debit card and the like for free. For financial activities such as fund transfer, customer will be charged according to the transaction amount for example transactions charges for up to ₹10,000 are around ₹2.5 excluding GST.

Comments

Post a Comment

Have a question? Just ask in comment box!