Do you know out of 100 only 30 options buyers make money whereas more than 66% options seller always make easy money with help of Theta? It is because options sellers use successful options trading strategies with calculated risk. On the other hand, buyers like lottery buyers, buy option contracts with one and only strategy, "zero or hero".

Options buying demands excellent trading skills. You need to very precise and focused to earn money if you belong to this category because here timing is everything. At time in options buying, you will see huge profit but if you failed to book that at right time then in the blink of an eye Theta will vanish your profits.

On the contrary, options selling does not demand too much. You need money (because selling requires more money than buying) and you must be good at money management.

Selling comes with unlimited risk therefore you must have excellent money management skills. You should know when to exit timely with limited loss, in case trade went against you.

There are many successful options trading strategies out there. I am going to unveil mine. I have been using these trading strategies and these are too good to earn consistently.

These options selling strategies require above discussed things: money and money management.

I would like to suggest you back test each strategy at least for 21 times before actually start using them. This way you can trust them and in case of losing streaks, you would know that it does not matter you will be profitable in the end of the day.

Most Successful Options Trading Strategies

Before you learn these options trading strategies, must know that these strategies have variations and I have shared the best and profitable to start with.

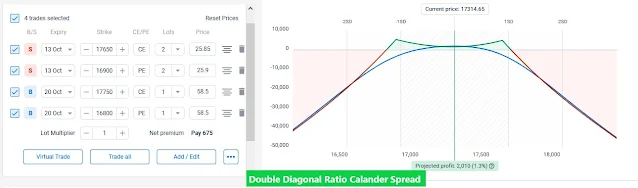

Double Diagonal Ratio Calendar Spread

Pros

- It provides large range.

- Best to earn 4%-5% monthly returns.

- Under VIX 19, its success rate is very high.

- If market closes in center of either triangle you will earn maximum profit.

- You will only losses in market crosses the triangle.

Cons

- Not recommended for VIX more than 21.

- In case of large gap up/down, it can show losses due to Delta.

Rule: Must exit when 3% capital loss you will see.

To make Double Diagonal Ratio Calendar Spread strategy:

- Sell 2 out-of-the-money CALL options from current weekly expiry

- Sell 2 out-of-the-money PUT options from current weekly expiry (price should be equal to CALL options you sold)

- Now from next week expiry, buy one CALL option whose price should be equal to sum of two CALL options you sold from current weekly expiry plus ±5.

- Also, buy a PUT option from next expiry whose price should be equal to sum of 2 PUT options you sold ±5.

Example;

Let's assume, you sold 2 CALL options at 10 each (total you collected 10*2=20); similarly, you sold 2 PUT options at 10 each ( so here too you collected 20 for two lots).

Now you have to buy 1 CALL option from next week expiry whose price should be premium you collected from CALL side (in above example, we collected 20) ±5. So we need to buy a CALL options whose value is close to 25.

Similarly, for PUT side we need to buy a PUT option with value close to 25 because from PUT side too we have collected 20 premium.

This way you can create double diagonal ratio calendar spread trading strategy.

Recommended for:

DDRCS strategy is best for those traders who would like to earn 4%-5% monthly returns. Don't take this strategy lightly. 4%-5% may sound small to you but yearly they become around 60% yearly.

Bank fixed deposit only gives to 6% yearly returns. Your ₹10Lakhs may turn ₹16Lakhs in a year if you could master this trading strategy.

Pro Tip: If you market remain sideways then start moving selling positions inside to increase middle profit.

Read: Max Pain Options: Understand and Start Using Like A Pro Trader

Short Iron Fly

Pros

- Best strategy for range bound market.

- Over 60% win trade which means out 10, 6 will be win trades.

- Under VIX 17, its success rate is very high.

- If market closes in center of triangle you will earn maximum profit.

- It is a fixed risk strategy.

Cons

- Not recommended for VIX more than 21.

- In case of large gap up/down, Iron Fly will fail.

- Market must remain in range; otherwise, IF will fail.

Here are comes the most successful options trading strategy that every option seller practices.

Short Iron Fly is a fixed risk trading strategy. It gives higher returns comparatively less loss which is why every option seller practices it in range bound market.

To create short Iron Fly:

- Sell at-the-money CALL

- Sell at-the-money PUT

- Buy out-of-the-money CALL

- Buy out-of-the-money PUT

Example;

To make this strategy, first create a straddle which means sell ATM CALL and PUT options. Let's assume we trading Bank Nifty, market is at 35500 strike price. And at 35500, CE and PE you sold have 510 and 520 prices respectively. So this way you have collected total 1030 premium.

Now you have you hedge this straddle by buying OTM CE and PE option contracts.

To know which strike price to buy as hedge use following formula:

- For CE Hedge= CE Sell Strike Price + Total Premium You Collected

- For PE Hedge= PE Sell Strike Price - Total Premium Collected

For example; As per the above example, we sold 35500 strike price straddle and our CE selling price is 510 and PE selling price is 520. We have collected total premium (510+520=1030). So we need to buy hedge for CE side 35500+1030=36530 (in round figure we can buy 36500CE as CE hedge). Similarly, for PE side, 35500-1030=34470 (in round figure choose 34500 as PE hedge).

Recommended for:

If market is sideways and your analysis are telling you that it will remain sideways for the next few days then you can place Iron Fly strategy.

Read: Top 5 Advantages and Limitations of Zerodha

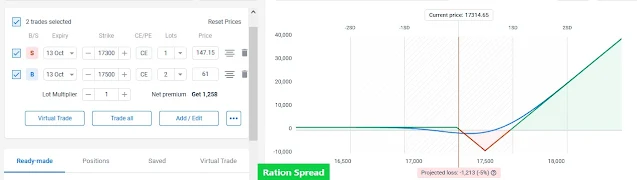

Ration Spread Options Selling Strategy

Pros

- Best for directional view.

- If your view is correct you will be rewarded.

- If you spot a breakout then place this strategy.

- If market closed above the breakeven you will earn fixed profit.

Cons

- Not recommended for VIX less than 13.

- Market must go in respective direction or at least remain above your breakeven to earn profit.

If you have bullish or bearish market view then Ration Spread can be made. Just Sell 1 ATM PUT option, if you’re bullish and buy 2 OTM PUT options.

Or if you think market will fall then sell 1 ATM CALL and buy 2 OTM CALL options.

If market reacted as you reckoned or at least remain above your breakeven point then you will earn fixed reward.

Calendar Spread

Pros

- Suitable when you think market may move in one direction or remain sideways.

- If your view is correct you will be rewarded.

- If market expired in center of either triangle then you will make money from your trade.

- If market remain calm then you will earn little profit.

Cons

- Not recommended for high VIX.

- Market must not go beyond your breakeven points lest you will make loss.

For Calendar Spread, SELL 1 OTM CALL plus PUT of current expiry and BUY 1 CALL plus PUT of next week expiry whose premium should be equal to sum of 2 lots you sold ±5 points. (to understand better see Double Diagonal Ratio Calendar Spread strategy example)

Must exit when 3% capital loss you will see.

In calendar spread, current week's options you sold will melt because less time value whereas next week expiry's premiums will hold because of more time value left and high delta.

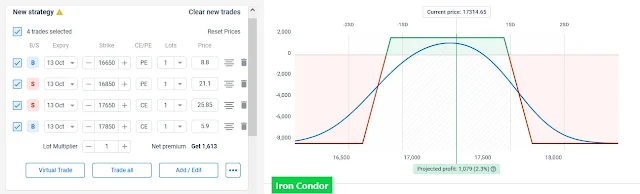

Iron Condor

Pros

- Highest win rate trading strategy, up to 80%.

- Provides large sideways range which increases win rate.

- Requires less capital.

Cons

- Low risk reward ratio

Iron Condor is a most successful trading strategy I have ever found. Surprisingly, its win rate is up to 80%. Out of 10 trades, 8 win be winning ones.

Iron Condor is a boring trading strategy. It does not thrill traders therefore many avoid them. It is a hard truth that most trades, do trading for thrill. They even not aware that they are addicted to trading.

If they were not, then they would be earning easy 1% weekly returns by only trading Iron Condor.

If you do trading to earn money then simply sell far far OTM PE and CE options with max profit 1% of your capital.

This way you can make 4% monthly and 48% yearly. You capital will grow slowly but certainly.

To create Iron Condor, sell far OTM CALL and PUT where market will not reach and buy 200 points away hedges. Max profit should be 1% of deployed capital.

Deploy this trading strategy, choose 4th or 5th day of weekly expiry and on 7th day wait for options to become zero.

Now again wait for 4th or 5th day and reapply the strategy.

Recommended for:

Iron Condor is for serious traders who want to earn from market, not seeking thrill and excitement of trading.

48% yearly profit is not a small thing.

Short Strangle

Pros

- High win rate trading strategy, up to 70%.

- Provides large sideways range which increases win rate.

Cons

- Low risk reward ratio

- Requires high capital

- Highly risky if VIX is more than 21.

When you sell Out-of-the-Money CALL and PUT options together, it becomes short strangle. When you think market will be sideways then you can deploy this trading strategy.

Short strangle gives you less profit as compared to Iron Fly but in returns it provides you big range.

Simply, sell far OTM CE and PE options to earn from trading regularly.

Due to brokerage issue, you should have more capital to really earn from this strategy, at least trade with 2 lots. It is not good for small quantity trading.

Recommended for:

Shot strangle trading strategy is very profitable if you have good capital, at least to trade 4lots. If you have then all you need to do is just sell far OTM options with very less premium.

Bear CALL Spread

Pros

- Gives 1:1 risk reward.

- Probability of profit is high because all you need to do is find a resistance level.

- Limited risk strategy.

Cons

- Your view has to be right.

If you think market will go down but not too much and you have capital to sell options instead of options buying choose Bear Call Spread strategy to take advantage of Theta decay too.

All you need to do is sell near ATM CALL option and buy further OTM CALL.

If your view proved to be right then you will earn certain profit from trading bear CALL spread.

Just find a strong resistance level which market would certainly hold till weekly expiry.

Short Straddle

Pros

- Highly rewarding.

- Best for sideways market.

- Best trading strategy to take advantage of theta decay.

Cons

- Highly risky.

- If you did not exit timely then it can give you very big losses.

Short straddle strategy is highly risky and not recommended for newbie traders. It is very rewarding too.

Just sell ATM CALL and PUT to create a straddle.

If you are the one who cut losses without showing hesitation then you can try this strategy.

Short straddle trading strategy's win rate is not high. Your stop losses will hit frequently but still you will be profitable in the end of the day.

All you need to do is master risk management. Always decide stop loss before you place short straddle strategy, ideally 3% of capital.

Once losses reaches to your 3% capital exit from the trade.

One important rule is that never ever deploy straddle if VIX is more than 21.

Volatility Index more than 21 makes market wildly volatile which is not good for straddle.

Ideally if VIX is under 17, short straddle gives maximum win rate.

Recommended for:

Traders with right trading psychology and mind set who does not feel uncomfortable in case of straddle showing losses and can easily exit if stop loss hit.

Bull PUT Spread

Pros

- Gives 1:1 risk reward.

- Probability of profit is high because all you need to do is find a resistance level.

- Limited risk strategy.

Cons

- Your view has to be right.

If your view is market will go up but not too much then simply sell 1 ATM or near ATM PUT and buy 1 OTM PUT Options to make a BULL PUT Spread trading strategy.

If market remain above your trade breakeven point then you will make fixed profit.

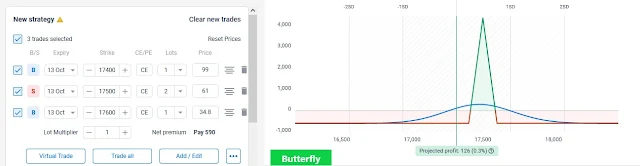

Butterfly Strategy

After some trading experience, we start understanding market structure. We start knowing that after range bound market trending market will come and vice versa.

But no one including professional traders can precisely tell you in which direction market will go after a range bound market.

When you know it is time for market to pick a trend but you are not sure in which direction market will move then you can take advantage of butterfly trading strategy.

I am certain you would have heard of butterfly before but did you know how to use it?

Don't fret.

You will learn today.

First when you're not certain of market direction, create butterfly strategy to capture market directional move.

To create butterfly, buy 1 CALL at lower price, sell 2 CALL options at higher price and buy 1 at even higher.

Now wait till any side breakeven is breached.

As soon as breakeven breached, close that side's buying position and bring it near to selling position. This way you will make that side profitable for yourself.

Note butterfly can be made on either side, I mean PUT as well as CALL side. Both sides will serve the same purpose.

I have created these strategies using Zerodha trading platform. Zeordha is one of the best trading platforms out there. Click on the following button to open your demat account:

Above were best successful options strategies. I have personally tested them throughout my trading career. They need patient and right mind set.

Also, remember thrill traders never earn money from trading. Always calm and boring ones stand out of 90% losers.

If you are completely beginner then start with Iron Condor with 1% max profit strategy.

Comments

Post a Comment

Have a question? Just ask in comment box!