In this piece of content, we will learn what are the different types of heath insurance and why is it important to have a medical insurance policy. If you're going to get insured against unforeseen medical emergencies then knowing the different types will help you choose a best option.

Like Life Insurance, a health insurance policy is a legal contract between insurer and insured; in which insured pays premiums and in returns, insurer agrees to pay for medical expenses for a specified limit or up to the sum insured in the event of medical emergency.

Health insurance is a best option for those who are unable to bear the unexpected or none-anticipated medical expenses arising from medical emergency or illness.

Most of health insurance policies provide cover between $1000 to $10000 (₹100000 to ₹500000); however, you can buy medical insurance cover between $10000 to $50000 (₹500000 to ₹50 Lakh) or more.

Today, many insurance companies offer different types of health insurance plans. In which the expenses of hospital, critical illness, cancer, and the like are covered. And in the event of death of the insured, the nominee gets the sum insured.

Let's understand what are its different types of health insurance plans are there.

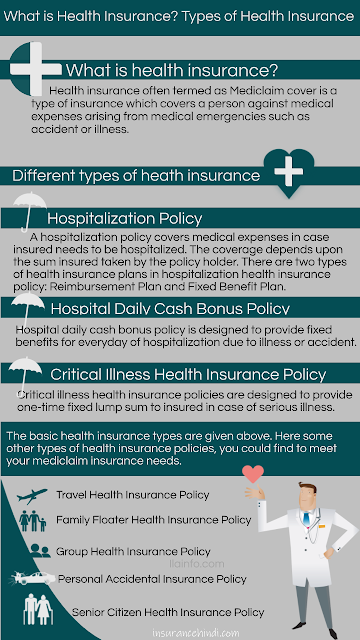

Different Types of Heath Insurance Plans

Basically there are main three types of health insurance:

- Hospitalization Policy

- Hospital Daily Cash Bonus Policy

- Critical Illness Health Insurance Policy

Apart from that, now insurers have started making tailor-made policy to cover certain deceases such as Cancer Policy, Typhoid Care Policy and the like. And due to Corona Virus threat, there is no wonder if some insurers would introduce a policy to cover illness due to Corona Virus.

Therefore if we talk about types of health insurance then there are only three main types and all other policies come under any of them.

Following are some of the best know health insurance plans that insurers offer nowadays:

Hospitalization Policy

A hospitalization policy covers medical expenses in case insured needs to be hospitalized. The coverage depends upon the sum insured taken by the policy holder. In this type of health insurance policy, one can find a number of products having varying payouts and different expenditures for different members of the policy.

There are two types of health insurance plans in hospitalization health insurance policy: Reimbursement Plan and Fixed Benefit Plan.

These policies also provide per-hospitalization and post-hospitalization coverage.

Hospital Daily Cash Bonus Policy

Hospital daily cash bonus policy is designed to provide fixed benefits for everyday of hospitalization due to illness or accident. Irrespective to daily hospitalization charges, this policy gives a daily fixed sum of money to insured.

For example, let’s say John has purchased an $100/day hospital daily cash bonus health insurance policy and his daily hospital charges are (in case he’s hospitalized) $70/day, then regardless of daily hospital charges, John will receive $100/day from his health insurance provider.

In other case, if John’s daily hospital charges are $200/day then John will still receive $100 on daily basis from his insurer's side.

Critical Illness Health Insurance Policy

Critical illness health insurance policies are designed to provide one-time fixed lump sum to insured in case of serious illness. If the insured faces serious illness throughout the policy tenure and that is specified in his policy, then insured will certainly get a cash lump sum from his insurance company.

These plans provide coverage for serious medical conditions such as heart attack, cancer, kidney failure, stroke, organ transplants and the like.

The basic health insurance types are given above. But, as I mentioned earlier, nowadays insurers have launched different types of health insurance plans to provide coverage against certain diseases and illnesses. Here some other types of health insurance policies, you could find to meet your mediclaim insurance needs.

Travel Health Insurance Policy

Travel health insurance policy provides reimbursement for medical expenses incurred in a hospital; when you’re on travel or vocation.

Usually, travel policy provides coverage if insured faces any type of medical issue while he’s traveling away from home. Travel health insurance offers many packages like; individual health travel insurance package, family health travel insurance package, student health travel insurance package, annual health travel insurance package (for those who travel often) and the like.

It is remarkable that travel insurance may not provide coverage for the medical conditions you had before applying for it.

Family Floater Health Insurance Policy

Family floater health insurance policy is tailored to provide health cover to your entire family. This type of health insurance policy is suitable for individuals who have dependents; because the single sum insured can be utilized among all insured family members.

Usually, in family floater health insurance, policyholder buys a single sum insured and adds his entire family in that. The major benefit of family floater plan is that in case one family member gets sick and has reached the sum insured per head limit then to cover the remaining hospitalization expenses, other members’ sum insured can be utilized.

This is why it's called family floater plan.

Usually, family floater plans cover individual, spouse and children (up to two); but some insurers offer to provide coverage to other dependents like parents and siblings.

Group Health Insurance Policy

Group health insurance policy covers a group of people. This policy is suitable for employers because as per law they have to provide certain health benefits to their employees.

By buying only one policy, employer can get coverage for all his employees.

Personal Accidental Insurance Policy

This type of health insurance covers an individual against accidents which may cause severe injury or death. Personal accidental insurance policy provides coverage against death or permanent disability due to an accident.

Tax Saving Health Insurance Policy

These policies are designed to provide tax benefits to an individual. Policy holder gets health cover along with tax benefits. This policy is designed to deliver tax benefits to policyholder for example under Sec 80D of the Indian income tax act 1961, one can seek tax rebate.

Senior Citizen Health Insurance Policy

This policy is tailored to give health coverage to senior citizens (between 60-80 years age). Insurance companies give reasonable discounts and offers to senior citizens.

After a medical check up, insured gets health coverage for future medical expenses and after 18-24 months threshold period insured gets medical coverage for pre-medical conditions too.

The policy covers prior to and post-hospitalization expenses, ambulance charges, prescription drugs, and hospitalization expenses incurred for the treatment of injury/illness.

Top-up covers

These polices are bought to increase the amount sum insured of an existing policy. Many people opt these covers to get covered for illnesses that an existing policy does not cover. Premiums are very low in such covers.

Here to be noticed that these policies cannot be bought alone. And their coverage starts only when regular health cover exhausts.

Micro insurance and health insurance for poorer sections

To give access to quality health care to economically weaker section, this policy is introduced by many nations. Eligible people get limited health cover after paying a very small amount as a premium.

Cancer Care Plan

Cancer is a curable disease if detected in early stage. But the cost of cancer treatment is very high and most of us are not financially prepared to fight against cancer.

Normal mediclaim policy does not provide cover for critical illness such as cancer. Therefore, insurance companies have introduced a comprehensive cancer care plan that provides financial support to insured against cancer.

These cancer care policies are available at very reasonable rates (approximately $10/month). Usually, cancer care plan gives a fixed lump sum to insured for cancer diagnosis and treatment.

Dengue Care Health Insurance Policy

After seeing significant cases of dengue, insurers have launched a new kind of health care policy called dengue care health insurance. This policy provides coverage for the treatment of dengue.

Above were all main types of health insurance. As I discussed in the beginning, insurers always work to provide tailor made policies to meet every individual needs therefore there is no wonder if we see more plans in the coming future.

Comments

Post a Comment

Have a question? Just ask in comment box!