In this post, we will see step-by-step application for cheque book in SBI. One who wants to get a State Bank of India cheque book is not need to visit his bank branch. He can follow the instructions given below. For your convenience, I've listed different ways to apply for cheque book in SBI including SMS, net banking, mobile banking and ATM. You can pick any way of your choice.

State Bank of India offers a variety of online services to its customers through its online banking channels like internet banking, SBI Yono mobile banking app, phone banking, USSD based mobile banking and application for cheque book.

If you're an active user of INB (Internet banking) or SBI Yono then you can perform many banking activities like quick transfer, fund transfer using NEFT, IMPS, or RTGS, block ATM/debit card, request a new ATM card, open e-deposit account and the like, right from your home or office.

Furthermore, for SBI cheque book apply online, one can use either SBI online banking or SBI Anywhere app.

Here are the Different Ways to Apply for Cheque Book in SBI

- Request cheque book through SMS

- Using net banking

- SBI cheque book request through mobile banking

- By visiting nearest SBI ATM

- By filling SBI cheque book request form (Branch visit required)

Let's discuss these methods one-by-one.

Application for Cheque Book by SMS

If you would like to apply for cheque book in SBI bank without visiting your bank branch and you're not a net banking user and mobile banking either, then you can do so by sending a SBI cheque book request SMS from your registered mobile number to 09223488888.

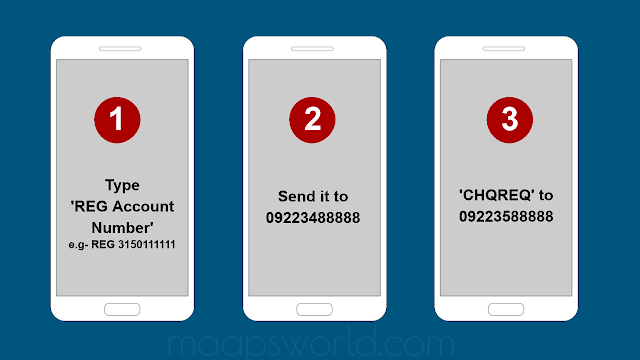

For that purpose, first you will need to activate SBI SMS banking by sending following text message from your registered mobile number: (Skip this step if already activated)

Send SMS, ‘REG Account Number’ to 09223488888 e.g. REG 3150111111

After sending text message in above format, a confirmation message will be sent to you indicating successful SMS banking registration.

Now for SBI cheque book request, send following SMS from your mobile to 09223588888:

'CHQREQ' to 09223588888

Make sure to send the message from registered mobile number.

You will then receive an SMS seeking your consent for cheque book request. To confirm that you actually have requested for the same, send SMS (CHQACCY6 digit no. received in SMS) to 09223588888.

That's it. Your application for Cheque Book in SBI is submitted successfully. You will soon receive a confirmation message from your bank.

How to Apply for Cheque Book in SBI using State Bank of India net banking

To make an SBI cheque book request online, you'll need to get access to your SBI net banking account. If you're not using the service then first you'll need to activate SBI net banking service. For activation, read this post, "SBI Net Banking online registration," tutorial.

Active users of State Bank of India can follow the instructions given below to submit application for SBI cheque book online.

Login to your SBI net banking account and from the SBI Online homepage move your mouse cursor onto 'Request & Enquiries' tab. Thereafter, from the drop down menu select 'Cheque Book Request'.

In the next step, click on the radio button next to your bank account number (see screenshot). Subsequently, select number of cheque leaves you want in your cheque book say 10, 25, 50. After selecting all the options, click on Submit button.

On the next page, you will be asked to the delivery address at which your State Bank of India Cheque book will be sent. You will have three options: Registered address, last available dispatch address, new address. Simply choose 'Registered address' if your address is updated in bank records.

Now verify your delivery address. Meanwhile, you'll receive one time password on your registered mobile number. Simply enter the OTP in the given box and hit Submit button again.

That's it. You'll receive your SBI cheque book with a week. You will also receive a confirmation message regarding your online cheque book application.

SBI cheque book request through mobile banking

In our recent post, we have learned how to activate SBI Yono mobile banking service. If you've not activate the service yet then you should read that post before following the instructions given below.

Bank replaced SBI Anywhere mobile banking app with its new SBI Yono app. Users can login to their State Bank of India mobile banking app to apply for cheque book in SBI online. Just follow the steps given below to do so.

- Get access to your SBI Yono Lite app and tap on 'Requests'.

- From the list of options, tap 'Cheque Book'.

- Touch 'Cheque Book Request'.

- Then select your account by tapping on the drop down menu. In the next step, select 1 in number of cheque books and 10, 25, 50 (as per requirement) in number of cheque leaves. Subsequently, tap on 'Request'.

- Now verify your delivery address if it's right then hit 'Confirm' button for final submission. That's it. You can read successful SBI cheque book request submission message on your mobile screen.

- You'll receive your State Bank of India cheque book on your address (address available in the Bank's records) within a week.

By visiting nearest SBI ATM

Customers of State Bank of India can also visit nearest ATM for applying for cheque book. For SBI cheque book request through ATM, follow these steps:

- Visit an SBI ATM and swipe your debit card.

- Enter your PIN.

- From the list of options, select 'Services'. Note: On some ATMs, 'Cheque Book Request' options appears on the main screen.

- Next, select 'Request Cheque Book'.

- Choose number of cheques and number of leaves for the same.

- Confirm your SBI cheque book request.

By filling SBI cheque book request form

Not able to follow above mentioned ways to apply for cheque book in SBI? Then, visit your home bank branch and fill SBI cheque book request form. After submission, you can collect your cheque book from your home State Bank of India branch or it will be delivered to your physical address by post.

Frequently Asked Questions

Is cheque book free in SBI?

State Bank of India gives first 10 cheque leaves free in a financial year for savings bank account and 50 for current accounts. Apart from that, 50 leaves free for senior citizens and salary accounts. Also, 20 leaves free per year for other P-segment and AGL segment customers. Afterwards, customers will be charged accordingly.

Afterwards, customers will be charged accordingly. For example 10 Leaf Cheque Book at ₹40 excluding GST and ₹3 per cheque leaf for savings account and current account respectively.

Here are SBI cheque book charges:

For Savings Bank Account:

- First 10 cheque leaves free in a financial year.

- Extra 10 Leaf Cheque Book at ₹40/- excluding GST.

- 25 Leaf Cheque Book at ₹75/- excluding GST.

For Current Bank Account: (GST is applicable)

- First 50 cheque leaves free in a financial year.

- Thereafter ₹3 per cheque leaf.

- 25 Leaf cheque Book at ₹75.

- 50 Leaf Cheque Book at ₹150.

Charges based upon Quarterly Average Balance (QAB)

- For all savings bank accounts having QAB below ₹25000 charges will be ₹3 per cheque leave.

- Account having quarterly average balance above ₹2500 charges will be ₹2 per cheque leave.

Apart from that, 50 leaves free for senior citizens and salary accounts. Also, 20 leaves free per year for other P-segment and AGL segment customers.

How can I get SBI Cheque book by SMS?

SMS Banking users can send following text message 'CHQREQ' to 09223588888 to request a cheque book in SBI by SMS. After sending the SMS, you will need to confirm your request.

How long does it take to get Cheque book from SBI?

After receiving a cheque book request, bank sends the same within 7 working days. Customer can collect his cheque book from his bank or it will be sent by post.

Can I get SBI Cheque book same day?

If needed urgently then customer can choose 'Emergency Cheque Book' option by paying ₹50/- + GST for 10 cheque leaves. For that purpose, visit your home bank branch and apply for 'Emergency Cheque Book'.

Comments

Post a Comment

Have a question? Just ask in comment box!