Are you thinking of cancelling insurance policy? Do you know that you have some options to meet your financial needs without cancelling insurance policy and you only get a small portion of your premium paid as Surrender Value? Here as an insurance advisor I will help you come on a wise decision.

This post is especially written for those who are cancelling insurance to meet their financial needs or are unable to pay premiums. After reading this post, you will know that you have much beneficial options in your hands than surrendering life policy.

If you do not know there are other options available then you are at a right place. Here, I will show you some options that you can consider before cancelling insurance policy.

For your knowledge, policy surrender is not a good option because it is subject to surrender charges. Therefore, before doing so, you should think of other options available.

Probably, you would know that on termination of life insurance contract, you get only the bonus earned (through investment component) which is significantly less as compared to the premiums paid.

Insurance companies invest some percentage of your premium in stock market or in other investment components and tailor your policy in such a way that you get fixed benefits upon maturity.

But if you cancel life insurance policy before the policy term then your insurer is not liable to pay you the sum assured.

Therefore, it is advisable not to surrender life insurance policy and find other ways to meet your financial needs.

Do you know that by surrendering your policy you lose the opportunity to earn long term returns on your savings portfolio?

Your life insurance policy will stop which means your insurance company will no longer cover you?

If yes then you might really be in a critical condition.

I understand that sometimes due to some reasons we need to take such difficult decisions (policy surrender). All I want is to make you aware of other options (in fact better ones) before taking such a difficult decision.

Maybe one of them is of your use and you can tackle the situation without discontinuing policy.

You're reading policy surrender guide:

- Don't Cancel Life Insurance Without Considering these options (Currently, you are here)

- Policy surrender FAQ (must read before you can cancel your contract)

- How to calculate surrender value?

- How to surrender life insurance policy?

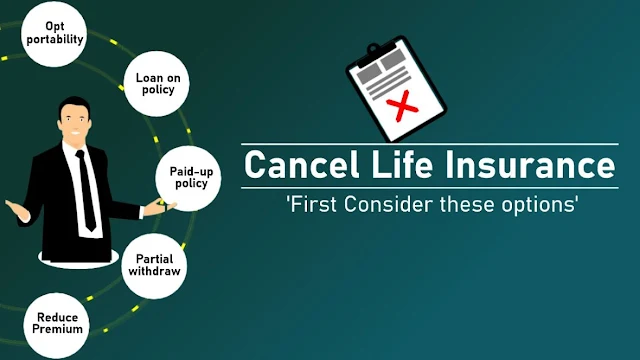

Consider these options before cancelling insurance policy

Here some policy surrender alternatives you should think of before you cancel life insurance contract:

- Convert your policy into paid-up

- Take a loan on life insurance policy

- Request partial withdraw

- Convert your insurance policy

- Opt portability

- Reduce your life insurance premium

- Insurance policy assignment

Convert your policy into paid-up

The below two solutions can be used to arrange funds in an emergency situation. But if a person is reluctant to continue his insurance policy, then converting policy into paid-up is a much better option than discontinuing life insurance policy.

According to Insurance Act, there must be guaranteed surrender value if premiums have been paid for three consecutive years. Further amendment says, if the policy has not been surrendered by the policyholder it shall be remain in force as a policy with a reduced paid up value.

If you have paid the premiums for at least 3 years or till the lock-in period (time frame depends on insurance policy and company) then you can convert life insurance policy into a paid up policy.

What is paid up policy?

In a paid-up policy, policyholder stops paying premiums after the lock-in period but does not cancel his insurance contract. In that case policyholder has an option to convert his policy into a paid-up policy.

To do this, policyholder has to contact his insurance agent or insurance company and submit a written application.

At the time of maturity, policyholder is entitled to receive sum assured along with the cash value and bonus (if any) accrued according to the premiums paid.

Note : If you would like to convert your policy to paid-up, you will be required to pay the premiums till the lock-in period ends.

Doing so would be more beneficial than discontinuing life insurance policy.

Take a loan on life insurance policy

You may not know that you can take a loan on your life insurance policy. I suggest that you consider this option to meet your urgent needs.

Although it is not advisable to take a loan on life insurance policy but you can choose this option if you need money urgently. How much loan you can get depends on how old your policy is and how much cash value does it acquire?

To meet urgent money requirements, loan on policy is a batter option than cancelling your policy.

Partial withdrawal

Some life insurance policies that have investment instruments come with options like partial withdrawal. Partial withdrawal facility lets policyholders withdraw a portion of the cash accumulated in their portfolio.

For example, if your insurance investment portfolio has accumulated ₹1 Lac ($1500) and your policy allows partial withdraw of 25% or 30% (actual percentage depends on your policy) then you can withdraw ₹25K to ₹30K ($375-$450).

If your policy comes with a partial withdrawal option, you can take advantage of it to fulfill your financial needs.

I personally suggest you think of this option if you policy cancellation reason is financial.

Policy convertibility

If you are going to discontinue life insurance policy and buy another one, first see if your existing policy is convertible. Some insurance companies allow policyholder convert his policy without cancelling existing one.

Which means you can switch from one plan to another without cancelling your existing life insurance contract.

Port your policy

Insurance marketplace has evolved by leaps and bounds. Now policyholders have a number of options from convertible policy to insurance policy portability.

Those who are not satisfied with the services of their insurer can think of porting their policy to another insurer. Insurance policy portability would a much better option for you than surrendering insurance policy (if the reason is insurance company's bad reputation).

Reduce life insurance premium

If your insurance premium is out of your pocket and you're struggling to to pay it then you can reduce your life insurance premium by contacting your insurance company.

Doing so will also reduce your sum insured. But you will be able to keep your policy in force. After all being under-insured is much better than being not insured.

Life insurance assignment

Life insurance assignment is a term you should be aware of; especially if you're considering policy surrender. In insurance assignment, you transfer your policy ownership to another person with due permission of your insurance company.

In insurance assignment, nothing changes pertaining to your policy (be it benefits, sum insured, maturity benefits, cash value, terms and conditions and the like) just ownership and benefits gets transferred to third party.

Person who transfers the ownership is called 'Assigner' and who receives the ownership is called 'Assignee'.

I never suggest you become uninsured but if you going through hard times and you're in such a situation where it's almost impossible for you to continue your policy then you can think of this option.

It is much better than surrendering life insurance policy. Just find a person who is willing to take ownership of your policy and in returns agrees to pay you some cash (should be greater than surrender value).

Above were some options you must look at before you cancel life insurance policy.

If you do not find any of the above options helpful, then you can discontinue your life insurance policy. Or do further research. All I would like to suggest you at pen off is don't rush take your time.

Frequently Asked Questions

What is an assignment in life insurance?

In life insurance assignment enables a policyholder transfer his policy ownership rights to a third party. This way policy benefits and its sum insured remain intact, just the policy ownership goes from one person to another.

Before assigning insurance policy to someone else, policyholder will be required to obtain written consent from his insurance company. Without the insurer's permission, life insurance assignment will be invalid.

If one is unable to continue his policy, he can take advantage of policy assignment option. All he needs to do is just find someone who is willing to take ownership of his policy and in return is willing to pay some cash in hand.

It will be win-win situation for both parties. Who? You will get amount more than surrender value will offer you and buyer (who will purchase policy from you) will get maturity benefits.

What is partial withdrawal?

If policyholder has paid the premiums till the lock-in period and his policy has accrued some cash value then policyholder can withdraw a part of that cash value in the form of partial withdrawal.

Policyholder doesn't need to repay that amount and no interest will be charged on it. It's his money and according to his policy surrender rules, he can request partial withdrawal.

Percentage of partial withdrawal ranges for 20-30 percent but it can vary from policy to policy.

At pen off, I would like to suggest you that cancelling insurance is not a good option. I would rather suggest you seek other options like lowering your premiums.

Comments

Post a Comment

Have a question? Just ask in comment box!